35+ How to determine borrowing capacity

Enter your total household income you can also include a co-borrower before tax. Click Now Apply Online.

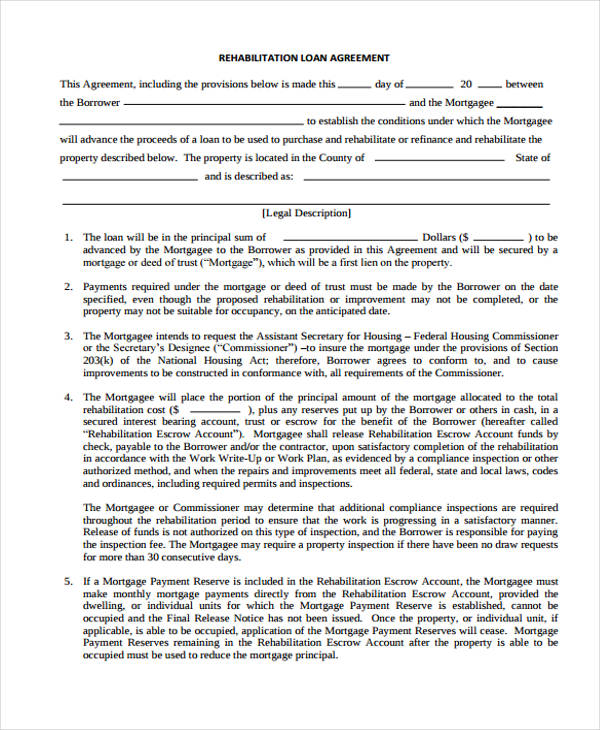

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Even if this is not the only element taken into consideration.

. When it comes to existing mortgages lenders may either choose to use the actual repayments or use a higher assessment rate to calculate your borrowing capacity. Buying or investing in a new property we have a variety of tools and calculators to. The Collateral Customer Summary - Collateral Position Report indicates your current borrowing capacity based on collateral pledged and available.

The external factors include. Some factors that affect a borrowers capacity are external and therefore have little to do with the specific characteristics of the company. Using a borrowing calculator can easily provide you a clear indication of how much you can borrow with a few clicks of a button.

Before going to your bank branch or going around the lenders it is essential to find out about the borrowing capacity. And not the gross income but the after-tax income. Get Instantly Matched with the Best Personal Loan Option for You.

When you borrow like this the bank will finance up to 70 of the amount of your project the remaining 30 must then come from personal contributions or money from relatives namely the. How can I determine my current borrowing capacity with respect to collateral. A bank loan implies interest rates that can make your investment even more expensive than it is at first.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. This allows the remaining 60 65 or 70 of income to be used for essential expenses and for savings. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance.

Typically borrowing power depends on your income deposit size living expenses credit score home loan type interest rate other assets and property priceLets take a closer look at each of these. Thus as part of calculating your borrowing capacity it is also wise to ask your lender what is going to be the interest rate for your loan. Total Net Income Total Repayments Living Costs Your Net Surplus Income.

Compare home buying options today. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. In most cases income from commissions bonuses overtime tips rental income and child support can all be counted toward your annual income.

Its as simple as entering your individual circumstances and. View your borrowing capacity and estimated home loan repayments. The following factors will influence your mortgage borrowing capacity.

Examine the interest rates. How much your annual salary is before tax. Your borrowing capacity is the maximum amount lenders will loan to you.

Total Debt Total Gross Income Debt to Income Ratio DTI. Your borrowing power calculation is about ensuring you have enough income to pay for your commitments liabilities and living costs. The first and most obvious factor is your income.

How To Calculate Your Mortgage Borrowing Capacity. How much rental income you receive from properties. Moreover the greater your deposit the more money you can borrow.

Include your and your co-borrowers. Essentially your borrowing capacity is determined by figuring out the difference between your net income what you get paid after taxes minus your total monthly expenses. A debt to equity ratio that is greater than one means that a business is likely to have harder access to funds.

Lenders will determine this factor when youre applying for finance. Your borrowing capacity is the maximum amount lenders will loan to you. It can be accessed via 1Linksm the FHLBNYs internet banking.

International Customers can call 675 305 7842. Industry structure must be analyzed by assessing the number of competitors the barriers to entry and exit the power of customers and suppliers. This applies even if the balance on your credit card.

How many applicants are applying for a mortgage. While there is a standard formula lenders follow lenders may assess your income or expenses differently. Common information needed to calculate your borrowing capacity.

Using a borrowing calculator can easily provide you a clear indication of how much you can borrow with a few clicks of a button. Typically a company with a good unused debt capacity will have a debt to equity ratio of less than one meaning they have easier access to money. Theres also two calcuations that most lenders will undertake.

Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. The Bank of Spain advises that the maximum amount that a family borrows should not exceed 35. Lending capacity and can be reached at 212 441-6700.

Factors that contribute into the borrowing power calculation. Indeed it is a criterion taken into account by banks in their decision to lend you money or not. Debt capacity is a complex subject that requires a bit of diligence.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Home loan providers analyze income to determine how much a person can afford to pay for a mortgage. Everyones borrowing power for a home loan is different.

Skip the Bank Save. To calculate your borrowing capacity you may need to provide the following information to your lender. For credit cards banks will calculate a 2 to 3 minimum monthly repayment obligation of the approved credit limit.

How do banks calculate borrowing capacity. As an expat or foreign national your borrowing power will vary from a permanent resident. Therefore you have to relate your personal revenue and your.

A real estate project.

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Member Spotlight

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

2

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Presentation At The Capital One Southcoast Energy Conference

Annual Transition Report 20 F

Free 37 Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

How To Calculate The Ending Cash Balance Quora

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Financial Analysis

Free 6 Bank Loan Proposal Samples In Pdf

2